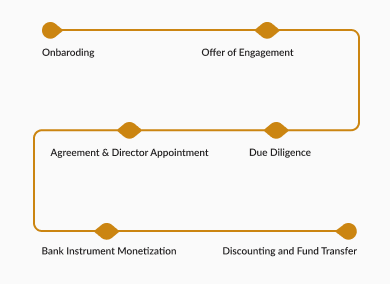

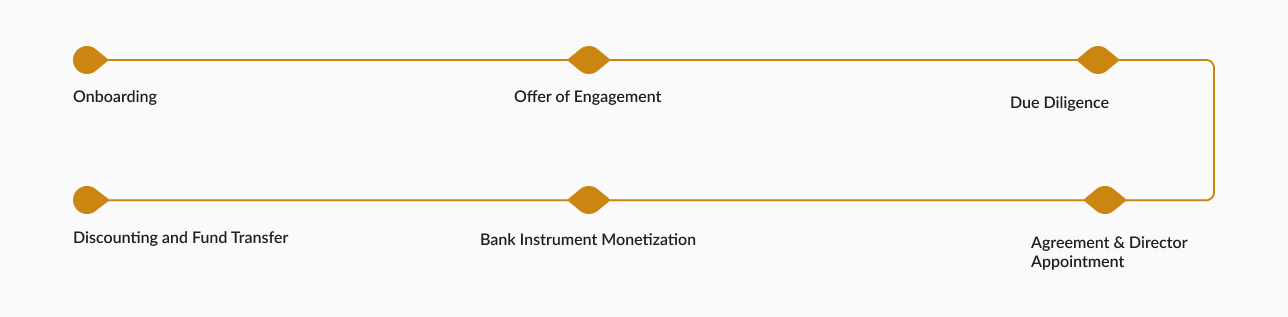

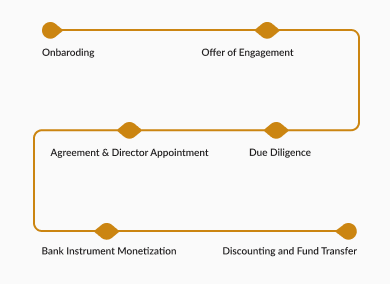

How It Works?

We simplify investing with a structured, step-by-step approach. To maximize the success of your project, we ensure transparency, efficiency, and strategic execution

Unlock the Value of Your Assets. Epiidosis Investments enables you to transform your assets into capital for growth, expansion, or debt consolidation. Our global reach and tailored solutions provide substantial growth potential in high-demand sectors.

Our track record of maximizing asset values is complemented by tailored strategies and expert financial insight. We optimize your assets for the best returns, making us a trusted financial partner.

From real estate and equities to intellectual property and digital assets, our team has a deep understanding of various asset classes. Using this expertise, assets can be monetized across a wide range.

Epiidosis Investments has a large network of industry contacts and investors to connect clients with the right buyers, partners, or financiers. As a result of this global reach, investors have more opportunities to monetize assets.

We identify the best opportunities for asset monetization based on comprehensive market research. By understanding market dynamics, our team can time asset sales or leases to maximize profits.

We offer a range of innovative financial solutions, including securitization, sale-leasebacks, and asset-backed loans. In addition to allowing flexibility in unlocking liquidity from assets, these solutions also offer options that do not require selling the assets outright.

We simplify investing with a structured, step-by-step approach. To maximize the success of your project, we ensure transparency, efficiency, and strategic execution

Epiidosis Investments streamlines the investment process with a structured, transparent approach, from registration to project management.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.

In this scenario, a company with a strong brand or product line expects significant future royalties but needs immediate funding in order to expand. In order to acquire these future royalties, Our team forms an SPV. The SPV issues securities to investors, backed by anticipated royalty streams. As a result, the firm receives a lump sum and the investors receive future income in return.

There are substantial receivables tied up in a large manufacturer's supply chain, which have a negative impact on its liquidity. In order to buy these receivables at a discount, our team creates a SPV. Upon receiving payments from these receivables, the SPV issues short-term commercial paper or other securities to investors. As a result, the manufacturer receives immediate working capital, and investors receive a return on their investments.

An investor has a commercial property portfolio, but needs liquidity to fund a new venture. Selling the properties directly would take time and reduce their value. As a solution, Epiidosis Investments creates an SPV to hold the properties and issue bonds backed by the assets. Investing in these instruments provides the developer with immediate liquidity. Revenue generated from the properties (e.g., rent) pays off the debt.

Technology companies own valuable patents and trademarks, but need capital to scale. The company does not want to sell its IP outright since it expects future growth. A SPV is created by Epiidosis Investments to hold IP assets, with securities or licenses backed by future revenues. While maintaining ownership of the company's intellectual property, investors provide the company with access to funds.

When a large infrastructure project is completed, such as a bridge, road, or airport, governments and businesses may need to refinance to settle construction debt or fund new projects. Epiidosis Investments' solution is to form an SPV to own infrastructure and issue bonds or equity instruments tied to future cash flows generated by the asset. Investors earn returns on these issuances, while debt can be repaid or new projects financed.

In this case, a renewable energy company has several operating solar or wind farms but needs additional capital to expand. Epiidosis Investments creates an SPV to acquire energy assets and issue green bonds or asset-backed securities backed by future revenue from energy sales. As a result, the company can raise capital while the SPV manages the cash flow, providing investors with steady returns.